Money are usually deposited by means of ACH for shipping and delivery upcoming organization day if accepted and signed by 4:thirty p.m ET on a standard company day from Monday – Saturday (besides federal holiday seasons). If the subsequent business enterprise day falls on the federal getaway, funding will occur on the next business working day.

This protection deposit normally sets your credit history limit. So If the stability deposit is, say, $three hundred, your credit Restrict might also be set at $three hundred. This gives the issuer some insurance plan in case you close the account without paying off your financial debt.

Applicants with scores In this particular range may be required to pay excess charges or to put down deposits on credit cards. Utility firms may additionally have to have deposits on devices or provider contracts.

It's possible you'll learn that house loan offers that exist to you feature higher interest prices which can set you back some huge cash. It’s vital that you consider the very long-term fiscal affect of an expensive loan, and it might be really worth having a while to build your credit rating before making use of.

Pupil loans are between the best loans to receive when you have a low credit score score, Given that approximately twenty five% of these are offered to applicants by using a credit score of three hundred-539. A new degree can also allow it to be simpler to repay the loan if it contributes to more income.

And you can even have a number of credit history reviews. The information used to work out your credit scores can come from unique experiences, developed by numerous credit history organizations, such as the a more info few main shopper credit rating bureaus (Equifax, Experian and TransUnion).

Having poor credit rating scores could make it a struggle for getting approved for unsecured credit. But in case you give attention to making your credit score after a while, you’ll probably start to qualify for more features with improved conditions and premiums.

Credit score utilization. Lenders and credit scorers Have got a technological expression for "maxing out" your bank cards by paying your full credit limit. They phone it pushing your credit history utilization ratio to 100%. They take into account it an exceptionally lousy notion, and that’s why doing this can substantially decreased your credit history rating.

Stay away from Speedy Fixes: Any corporation that advertises a chance to promptly “repair service” or “resolve” your credit score is a scam. There are no quickly remedies to bad credit history. Recovery is often a procedure that should probable choose at the very least 12-18 months, in order to development to your “reasonable” score.

If you have derogatory marks like accounts in collections or late payments on the studies, they ought to fall off your experiences in 7 yrs. Bankruptcies can remain on the experiences for around ten years.

Opinions expressed Listed below are writer’s by yourself, not Individuals of any financial institution, bank card issuer or other company, and possess not been reviewed, approved or if not endorsed by any of those entities, Except sponsorship is explicitly indicated.

Take into consideration a credit card debt-management strategy. For anyone who is owning hassle repaying your loans and charge cards, a personal debt-management plan could carry some relief. You work by using a non-earnings credit score-counseling agency to workout a manageable repayment routine. Getting into into a DMP correctly closes your charge card accounts.

Promotion allows WalletHub to provide you proprietary equipment, products and services, and written content at no demand. Advertising will not effect WalletHub's editorial articles like our best credit card picks, opinions, rankings and thoughts.

Compensate for Skipped Payments: In case you’ve skipped some regular payments, producing them up could assistance prevent credit score rating hurt from worsening, assuming your account hasn’t defaulted however.

Scott Baio Then & Now!

Scott Baio Then & Now! Tia Carrere Then & Now!

Tia Carrere Then & Now! Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Nadia Bjorlin Then & Now!

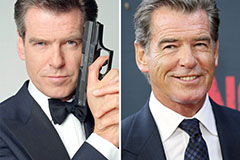

Nadia Bjorlin Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!